Debt Tracking Feature

Client

Venmo

My Role

Product Designer

Duration

6 Weeks

Challenge: While Venmo excels at sending and receiving money, it lacks an effective debt tracking feature. The goal was to develop an easy-to-use tool for tracking and managing debts within the app.

Process: Conducted competitor analysis and user interviews to identify existing solutions and user preferences, ensuring the design incorporated successful elements from the market.

Outcome: The new debt tracking feature enhanced user experience, simplifying financial management and increasing engagement with the app.

Overview

Venmo is a popular peer to peer money transferring app but it suffers from its significant limitations in tracking debts owed and debts pending. By conducting thorough research on the frequency and challenges of debt tracking among Venmo users, this project sought to understand the pain points and frustrations associated with current debt management methods. The goal was to design and implement an integrated debt tracking feature within Venmo, providing users with an intuitive and organized solution to manage their financial obligations more effectively, reduce misunderstandings, and improve overall user experience and satisfaction.

Research

The objective of this project was to determine the viability of a debt tracking feature on the Venmo platform. This feature would enable users to easily manage and monitor debts owed and debts owed to them, reducing reliance on memory or external tools, and minimizing misunderstandings, conflicts, and missed payments.

To accurately assess the needs of Venmo users, I conducted research to analyze the current market and identify the most common frustrations with existing debt tracking platforms.

Research Methods

Competitor Analysis: This approach involved examining similar apps to identify their features and understand how they address user pain points related to debt tracking.

Survey: I gathered quantitative data from Venmo users to capture their experiences and pinpoint common issues with managing debts.

User Interviews: Conducting interviews with Venmo users allowed me to obtain direct insight into how people currently use Venmo and the methods they use on and off the app to track debts.

Competitor Analysis

Challenges and Desired Features on Venmo

Keeping track and organizing debts (55%) and setting reminders about debts to pay (55%) are the main challenges encountered on Venmo. The features most desired for a debt tracking feature on Venmo include reminders for upcoming payments (55%), notifications for outstanding debts (50%), and clear visualization of debts (45%).

Survey Conclusion

The study's findings indicate a clear demand for debt tracking features in digital payment platforms, with users highlighting the importance of convenience, accessibility, and financial management tools. Venmo, as a popular platform, has the potential to enhance user experience and attract new users by incorporating a debt tracking feature.

User Interview

Research Synthesis

The positive response from my participants suggests the addition of a debt tracking feature could enhance user experience and attract new users. The study's findings highlighted the following key recommended features:

Reminders and Notifications: Implement automatic reminders and notifications to help users stay on top of payments and reduce awkwardness.

Receipt Itemization and Scanning: Provide itemized receipts and a scanning feature to accurately split and track expenses.

Visual Debt Tracking: Offer a visual representation of debts with clear indications of pending requests and notifications for owed amounts.

Nudge Button: Add a "nudge" button to remind people of outstanding payments in a non-confrontational manner.

Categorization and Donation Options: Categorize transactions and distinguish between spending and donations, including a streamlined option for charitable contributions.

Before gathering data from participants and volunteers, I conducted a competitor analysis to identify the strengths, weaknesses, and key features of existing debt tracking applications. This research provided insights into what is already effective in the market and highlighted the features users commonly need for tracking their debt.

Survey

To gather comprehensive quantitative data, I issued a survey to understand how users track their debts and identify their potential pain points.

Ideate

User Flow

Using the data collected during my research phase, I created a user flow to outline the connections between the recommended features for the debt tracking tool. I began by considering which features should come first and how the user would most likely expect to navigate through them.

Style Guide

I developed a basic style guide to emulate the elements observed on the Venmo native platform. This guide included fonts, color palettes, and spacing. By using these elements, I was able to recreate the look and feel of the Venmo platform.

Prototyping

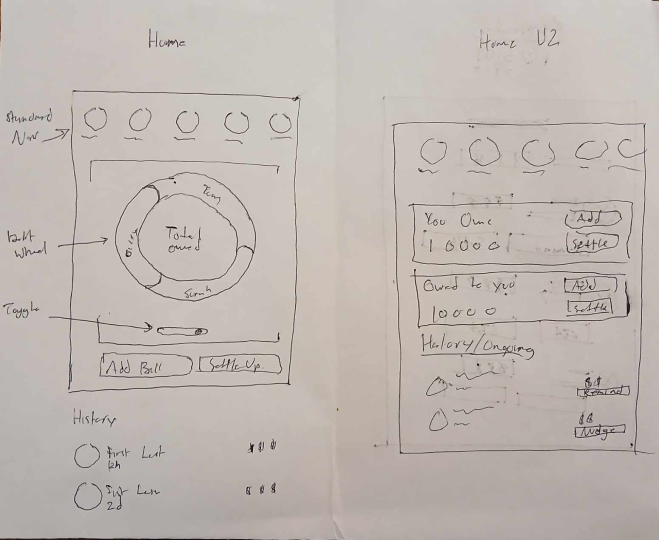

Low-fidelity Sketches

I started by sketching drafts of potential layouts for a debt tracking feature. Once I finalized a few designs, I transitioned to digital mockups to more easily refine and adjust their hierarchy.

Mid-fidelity Mockup

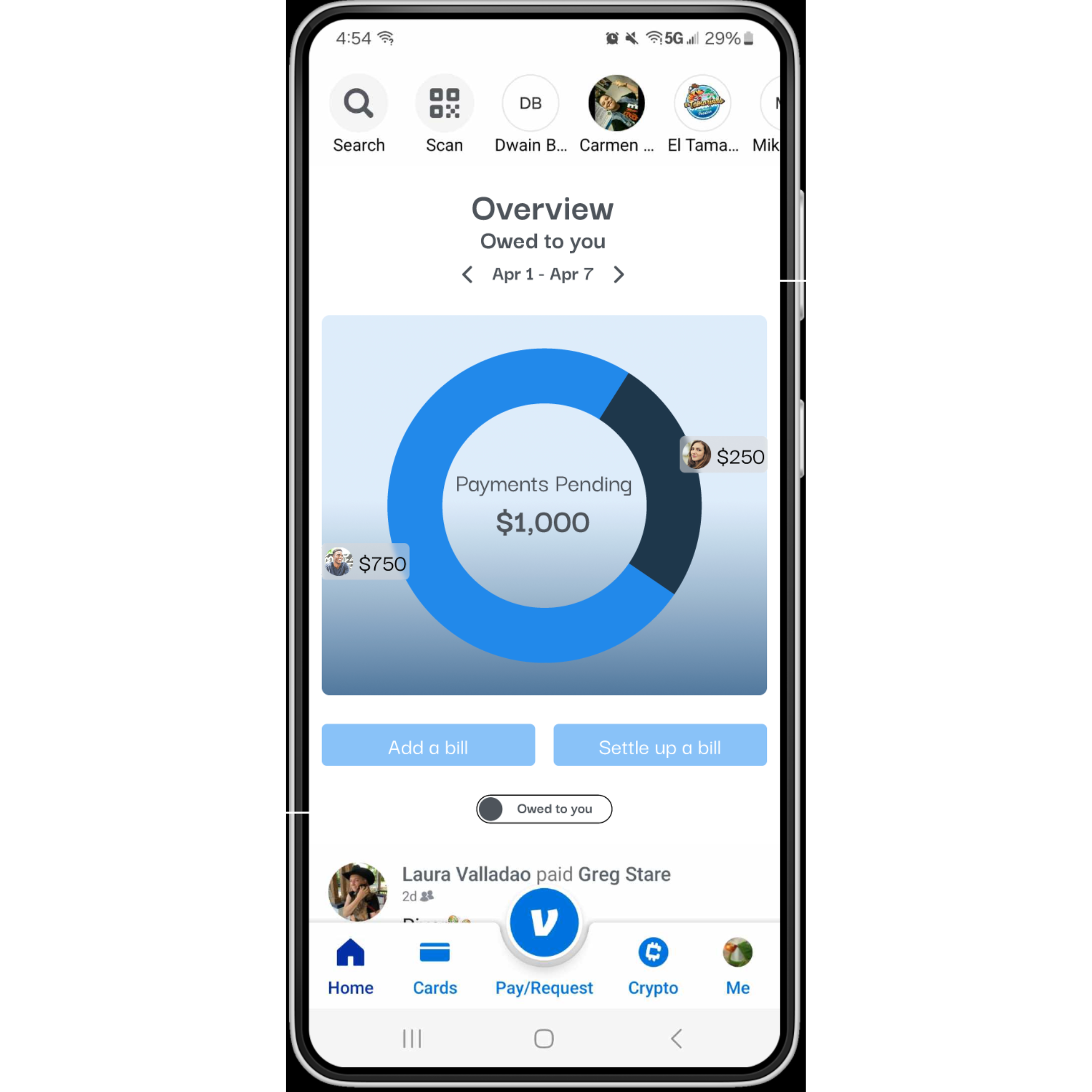

After testing the mid-fidelity mockup with a small group, several key changes were made to improve usability and clarity:

Rephrased "add bill" and "settle bill" CTAs, increased the size of the "notes" box, and adjusted the arrow in the "categories" section to face downwards.

Applied semi-bold styling to names to match Venmo's design standards and added an asterisk to indicate mandatory sections.

Rearranged the "split bill," "amount," and "scan receipt" sections for better flow, and added "total" to "total amount" for clarity.

Removed "send reminders" and "settle up" options from the reminders page.

High-fidelity Prototype

Prototype

User Testing

The objective of this user test was to evaluate the intuitiveness and integration of the newly added debt tracking feature on the Venmo platform. I assessed this by measuring how easily participants could complete tasks such as creating a new debt or bill, adding other users to the bill, and setting up reminders.

The Results

From the user test, participants found the debt tracking feature easy to use and very intuitive. The flow of tasks was logically sound, and participants encountered no issues navigating to the completion screen. The only major feedback highlighted was confusion around the toggle button for switching between the "owed to you" and "you owe" tabs.

Iteration

Based on the feedback provided in the user test, several iterations were made to improve the debt tracking feature. The toggle button was redesigned to reduce confusion and better mirror the style of Venmo. Additionally, the button's location was moved higher on the screen to give it better hierarchical relevance. The header and sub-headers were also redesigned to more clearly show their relationship with the visual elements, such as the debt tracking graph, enhancing overall user comprehension and navigation.

Takeaways

This project provided valuable insights into seamlessly integrating new features into an existing platform. I learned how to effectively evaluate elements from the Venmo platform to recreate a consistent style guide and apply these elements to my design. Additionally, I developed the ability to think critically about task flows, ensuring they align with the existing user experience and meet the expectations of current users. This project underscored the importance of user-centric design and the need for careful consideration of how new features fit within the established ecosystem of an app.